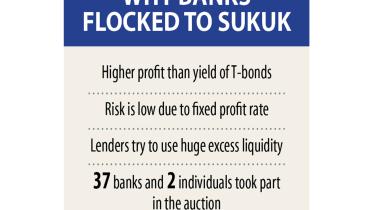

Sukuk era begins

Banks yesterday flocked to sukuk to invest their idle funds and manage a better yield than in conventional treasury bills and bonds as Bangladesh held its first-ever auction for the Islamic bond.

28 December 2020, 18:00 PM

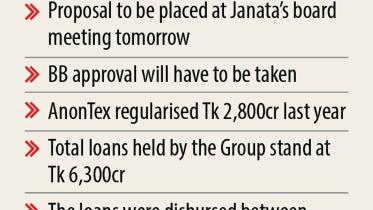

AnonTex seeks favour to reschedule loans

AnonTex Group, which was given Tk 5,500 crore in loans by Janata Bank breaching rules, has applied to the state-owned lender to reschedule its defaulted loans of Tk 3,742 crore.

27 December 2020, 18:00 PM

Tk 8,000cr Islamic bond for safe water supply

Bangladesh Bank will issue a sukuk next week, the first of its kind in Bangladesh, to raise Tk 8,000 crore for the implementation of a safe water supply project.

22 December 2020, 18:00 PM

FDI edges down for first time in 7 years

Foreign direct investment to Bangladesh dropped last fiscal year, the first decline in seven years, because of the pandemic-induced slowdown in business and regulatory barriers.

21 December 2020, 18:00 PM

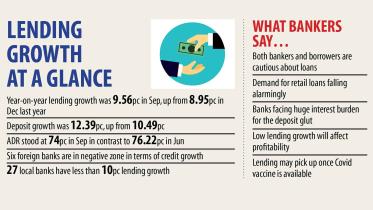

Banks’ lending growth slows down

Lending growth failed to keep pace with the deposit growth in banks in September, putting lenders in an uncomfortable situation as they cannot make the most of cheap funds because of depressed demand from borrowers.

20 December 2020, 18:00 PM

Pandemic slows green finance initiatives

Ananta Apparel and Universal Menswear -- two concerns of Ananta Group located in the Adamjee export processing zone in Narayanganj -- built green factories around four years ago.

16 December 2020, 18:00 PM

Savers left in limbo

Companies and well-off households are parking funds at banks in the form of deposits despite no return in real terms primarily because of lower investment and consumption caused by the pandemic-induced uncertainties.

15 December 2020, 18:00 PM

Credit card use back to pre-pandemic levels

Spending through credit cards reached the pre-pandemic levels in October in keeping with the economic recovery, a sign that clients are embracing the plastic money sidestepping the use of cash.

14 December 2020, 18:00 PM

Tk 1,000cr fund for factories’ tech upgrade

Bangladesh Bank is forming a Tk 1,000 crore fund to provide cheap loans to export-oriented industries to upgrade technologies they currently use.

13 December 2020, 18:00 PM

BB asks banks to keep extra Tk 10,000cr in provisioning

Banks will have to set aside an additional amount of around Tk 10,000 crore in provisioning to absorb shocks arising from the ongoing economic hardship caused by the coronavirus pandemic.

10 December 2020, 18:00 PM

Padma Bank seeks waiver of Tk 144cr fine

Padma Bank has applied for a rare regulatory forbearance, requesting that Bangladesh Bank waives its penalty of Tk 144 crore.

8 December 2020, 18:00 PM

Preventing Cyber-Attacks: Most banks ill-prepared

Only four of the 60 banks in the country have set up cyber security operation centres in line with a Bangladesh Bank directive to thwart large-scale cyber-attacks.

7 December 2020, 18:00 PM

Bangladesh Bank approves new bank

Bangladesh Bank yesterday approved one more commercial bank, taking the total number of banks in the country to 61.

7 December 2020, 18:00 PM

Banks have to set aside more funds to absorb shocks

Banks will have to keep aside more funds in provision than they usually maintain to make them well-equipped so that they can absorb shocks from any increase in bad debts caused by the business slowdown in the coming year.

5 December 2020, 18:00 PM

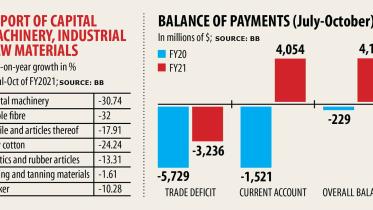

Imports for manufacturing slump

Imports for the manufacturing sector in Bangladesh plunged in the first four months of the current fiscal year, signalling to a weak economic recovery from the coronavirus pandemic.

2 December 2020, 18:00 PM

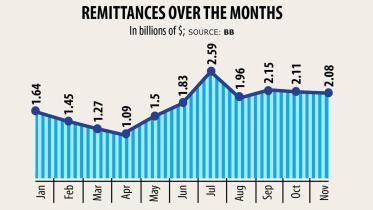

Remittance hits $2b mark for third straight month

Bangladesh has once again gone past the $2-billion mark in remittance income as migrant workers continued to send home a massive amount for the third straight month.

1 December 2020, 18:00 PM

HSBC arranges Tk250cr sustainability-linked loan for BSRM

The Hongkong and Shanghai Banking Corporation (HSBC) in Bangladesh has structured the country’s second sustainability linked loan for BSRM to help implement the steel manufacturer’s sustainability agenda.

30 November 2020, 18:00 PM

Default loans fall slightly for relaxed rules

Defaulted loans in the banking sector went down slightly in the third quarter this year thanks to the moratorium on bank loan payments provided by the central bank.

30 November 2020, 18:00 PM

Regulatory forbearance fuels banks’ capital

The banking sector’s capital base got stronger in the third quarter this year thanks to the regulatory forbearance provided by Bangladesh Bank.

29 November 2020, 18:00 PM

Cards after Covid-19

It was April when the government was compelled to enforce a lockdown across the country to keep the coronavirus pandemic at bay.

28 November 2020, 18:00 PM