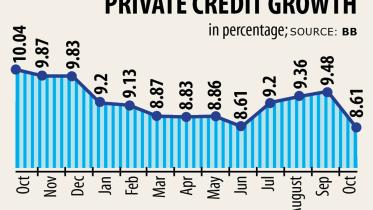

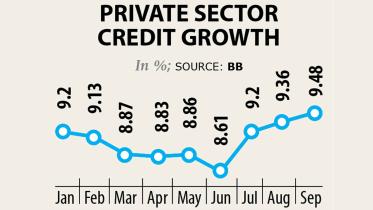

Deepening uncertainty downing credit growth

Private sector credit growth dropped heavily in October due to the eroding confidence of businesses amid the potential threat of a second wave of coronavirus infections.

26 November 2020, 18:00 PM

BKB, Rakub asked to reduce default loans, boost capital base

Bangladesh Bank yesterday asked two specialised banks to strengthen their financial health by bringing down default loans and boosting capital base.

25 November 2020, 18:00 PM

Breather for small borrowers

Bangladesh Bank yesterday cut the interest rate of a refinance scheme for the CMSME sector, which is one of the worst-affected sectors during the coronavirus pandemic, allowing borrowers to get term loans at 6 per cent instead of 9 per cent.

23 November 2020, 18:00 PM

Govt alerts banks about cyberattack threat

The government has alerted banks about the threat of a cyberattack, instructing them to put in place precautionary measures to prevent hackers from stealing money.

21 November 2020, 19:02 PM

Govt alerts banks about cyberattack threat

The government has alerted banks about the threat of a cyberattack, instructing them to put in place precautionary measures to prevent hackers from stealing money.

21 November 2020, 19:02 PM

Govt alerts banks about cyberattack

The government has alerted the banks about the threat of a cyberattack, instructing them to put in place precautionary measures to prevent hackers from stealing money.

21 November 2020, 18:00 PM

Banks’ excess liquidity doubles

Banks have faced excess funds in the recent period in the wake of a slower trend of investment against the large volume of money injection by the central bank into the financial sector.

21 November 2020, 18:00 PM

Credit card spending falls as consumers tighten belts

Spending through credit cards declined in September as consumers are still feeling the heat of the slower-than-expected economic recovery, while the threat of a second wave of coronavirus infections looms large.

19 November 2020, 18:00 PM

An extraordinary rise of remittance in extraordinary times

The largely battered hundi system because of travel restrictions, the zero-interest rate on deposit products in western countries, repeated floods in Bangladesh, and a massive collapse in demand in many nations hosting migrant workers from this South Asian nation have taken the inbound remittance to a level that was never seen before.

17 November 2020, 18:00 PM

Micro businesses can now accept digital payments

In a remote part of the country, a vegetable vendor wakes up early in the morning and goes to the nearest local market where wholesalers are available.

16 November 2020, 18:00 PM

Social Islami Bank now offers digital experience

Social Islami Bank has moved fast to transform its traditional banking services into digital ones amidst the ongoing economic hardship caused by the coronavirus pandemic, said its top executive.

15 November 2020, 18:00 PM

Govt caps MFS’s cash-out charge for safety net funds

The government decision to distribute the fund under its social safety net programme through mobile financial services will ensure transparency and bring more unbanked people under the formal financial system, according to industry people.

15 November 2020, 18:00 PM

Mutual Trust Bank going big digitally

Mutual Trust Bank has decided to go big in digital banking to provide services to the tech-savvy clients and bring the unbanked people under the formal financial system, said its top executive.

12 November 2020, 18:00 PM

No outsiders in board meetings, reminds BB

Some banks now permit outsiders to take part in their board of directors’ meetings, a practice that can be viewed as a breach of rules and severe lack of corporate governance in the banking sector.

12 November 2020, 18:00 PM

Agent banking winning hearts of remitters

Along with deposit mobilisation and loan disbursement, banks’ agent banking outlets are increasingly becoming the key point in distributing remittance in the remotest part of the country.

10 November 2020, 18:00 PM

Rising number of accounts takes banks closer to people

Globally, about 1.7 billion adults remain unbanked.

9 November 2020, 18:00 PM

Lenders witness surge in internet banking amid pandemic

Nayeem Uddin, a college teacher by profession, faced immense difficulty to settle banking transactions between April and May, when strict restrictions on movement were imposed by the government to curb spread of coronavirus.

7 November 2020, 18:00 PM

MFS transactions rebound strongly

Transactions through mobile financial services (MFS) rebounded strongly in September as people are preferring digital banking over the traditional one to adapt to running their life smoothly amid the coronavirus pandemic.

4 November 2020, 18:00 PM

BB issues guideline for credit guarantee scheme

Bangladesh Bank yesterday rolled out a guideline for the credit guarantee scheme (CGS) to give the much-needed boost to the cottage, small and micro enterprises (CSME) that are struggling to stay afloat amid the Covid-19 fallout.

3 November 2020, 18:00 PM

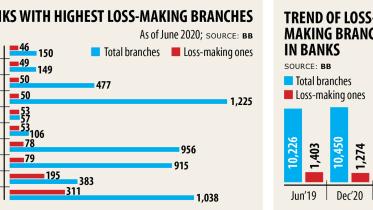

Banks see their loss-making branches soar

People’s reluctance to secure financial services in person amid the coronavirus pandemic and a lack of corporate governance have driven up the number of unprofitable branches of banks in Bangladesh.

3 November 2020, 18:00 PM