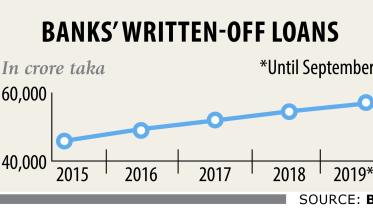

Loan write-offs rocket

Loans written off by banks escalated 42.66 percent year-on-year to Tk 1,640 crore in the first nine months of the year as lenders, awash with default loans, endeavoured to clean up their balance sheets.

28 December 2019, 18:00 PM

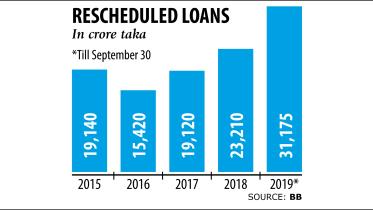

Loan rescheduling hits new high

Banks rescheduled a record amount of defaulted loans in the first nine months of 2019 as part of their efforts to contain bad debt and manage hefty profit, albeit artificially.

25 December 2019, 18:00 PM

GPS, GIS technologies to govern farm loans

Banks will give out farm loans based on satellite data so that farmers get credit without any hassle and cultivate crops in the appropriate land and atmosphere.

17 December 2019, 18:00 PM

Single Digit Interest Rate: Make govt deposits interest-free

It has always been the law of supply and demand that determined the interest rate at which one can borrow.

11 December 2019, 18:00 PM

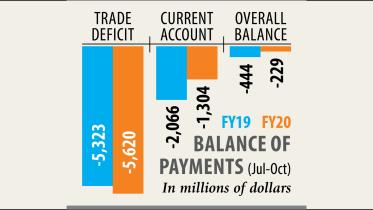

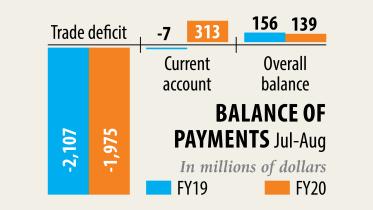

Trade deficit widens

Trade deficit widened slightly in the first four months of the fiscal year when exports fell more than imports, a development that has exposed the sluggishness of the economy.

9 December 2019, 18:00 PM

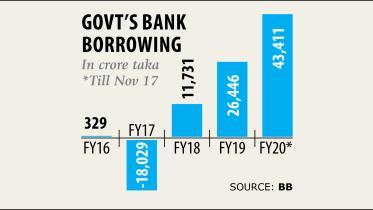

Govt’s Aggressive Bank Borrowing: Private sector may face credit crunch

The government is going to exceed its annual limit for bank borrowing within the first half of this fiscal year due to poor revenue collection, and this could give a credit crunch for the private sector to deal with.

2 December 2019, 18:00 PM

Non-Bank Financial Institutions: New one revving up, as others limp along

The central bank is set to give licence to a new non-bank financial institution (NBFI) -- a disconcerting move given that at least 10 of them are struggling to return funds to banks and customers upon maturity.

30 November 2019, 18:00 PM

12 banks face provision deficit of Tk 12,000cr

A dozen banks faced a combined provision shortfall of Tk 12,000 crore in the third quarter of 2019 in a sign that exposed their weakness to shield depositors’ funds from financial risks.

28 November 2019, 18:00 PM

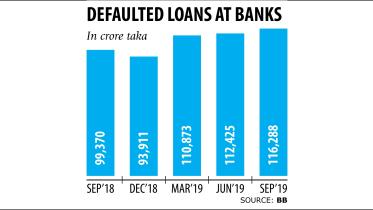

Defaulted loans hit all-time high

Defaulted loans surged 24 percent to Tk 116,288 crore in September compared to that in December last year, the amount being the highest in the country’s history, largely because of the central bank’s inertia to crack down on wilful defaulters.

27 November 2019, 18:00 PM

Govt’s borrowing from banks spirals

The government’s borrowing from banks has escalated alarmingly on the back of a revenue shortfall, a development that is poised to aggravate the already tight liquidity condition in the sector.

21 November 2019, 18:00 PM

Deposits dominate agent banking

Rural clients of agent banking are missing out on its benefits as loan disbursement amounted to less than 5 percent of the deposits collected as of September this year, highlighting lenders’ preference for deposit only.

16 November 2019, 18:00 PM

Online foreign card transactions face roadblock

International credit cardholders will face trouble in settling online transactions abroad as they will have to take prior approval from banks for every cross-boundary payment.

16 November 2019, 18:00 PM

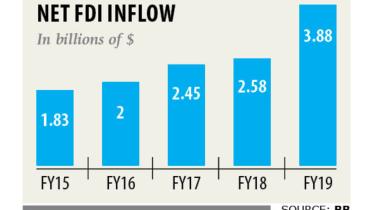

FDI hits all time high

Foreign direct investment to Bangladesh surged 51 percent last fiscal year to its highest on record, riding largely on Japan Tobacco Inc’s acquisition of Akij Group’s tobacco business for $1.47 billion.

12 November 2019, 18:00 PM

Trade deficit shrinks in first quarter

Trade deficit narrowed slightly in the first quarter of the fiscal year as both exports and imports declined, a development that can be construed as symptoms of an economic slowdown.

7 November 2019, 18:00 PM

Loan write-off policy to be eased again

The central bank is set to relax the loan write-off policy once again in a space of nine months, bowing down to pressures from an influential quarter.

6 November 2019, 18:00 PM

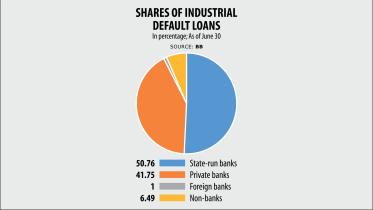

Industrial NPLs rise for habitual defaulters

Non-performing loans (NPLs) in the industrial sector soared 48.58 percent at the end of last fiscal year as habitual defaulters continued to show reluctance towards repayment of their rescheduled loans.

30 October 2019, 18:00 PM

IMF raises alarm

The rising defaults on loans poses the biggest risk for the Bangladesh economy that stands to grow at a remarkable pace, said the International Monetary Fund yesterday, raising the urgency level for the government to address the banking sector’s ills.

18 October 2019, 18:00 PM

Bangladesh to clock third highest growth

The Bangladesh economy is tipped to clock in the third highest growth in the world in 2019 on the back of its robust exports, remittance and manufacturing sector, according to the International Monetary Fund’s latest report, which was a thumping endorsement of the country’s growth momentum.

15 October 2019, 18:00 PM

Trade deficit narrows on falling imports

Trade deficit narrowed slightly in the first two months of the fiscal year, helped by a decrease in both imports and exports in a sign that the country’s overall business is facing sluggishness.

10 October 2019, 18:00 PM

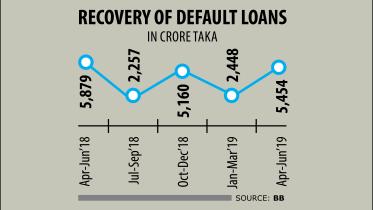

Loan recovery slows in Q2

Banks’ loan recovery momentum slowed down in the second quarter of 2019 as many defaulters showed unwillingness to pay back loans to enjoy the central bank’s relaxed rescheduling facility.

8 October 2019, 18:00 PM