Outrageous offer for a defaulter

Anyone would balk at the idea of granting yet another rescheduling facility to a defaulter who has outstanding loans of Tk 1,168 crore since 1993 and has not shown any genuine interest or effort in paying back its loans. But the Rupali Bank board didn’t.

4 October 2019, 18:00 PM

Undue intervention by boards causes troubles for lenders

Undue intervention by boards has become a major problem for lenders in Bangladesh, a situation which is creating not only a lot of troubles for top management but also hurting their financial health, said Arif Khan, managing director of IDLC Finance Ltd.

30 September 2019, 18:00 PM

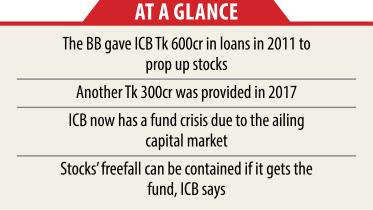

ICB seeks Tk 1,000cr from BB

The Investment Corporation of Bangladesh has sought Tk 1,000 crore in financial support from Bangladesh Bank on an “emergency basis” to inject liquidity into the ailing capital market as part of its concerted efforts to bring back investor confidence.

28 September 2019, 18:00 PM

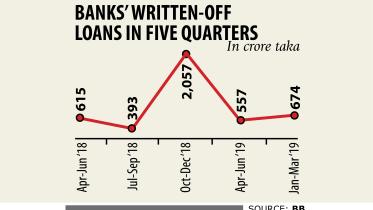

Written-off loans rise in Q2

Loans written off by banks surged 21 percent to Tk 54,463 crore in the second quarter of the year from a quarter ago as the lenders try to clean up balance sheets and paint a rosy picture of their health.

25 September 2019, 18:00 PM

Non-Performing Loans: Rescheduling hits a record Tk 15,469cr

Banks have rescheduled a record Tk 15,469 crore loans in the second quarter apparently to show on paper non-performing loans have reduced.

21 September 2019, 18:00 PM

Govt firm to buy NPLs by next year

The government plans to form an asset management company this fiscal year to buy distressed loans off banks as part of its efforts to

21 September 2019, 18:00 PM

BB caves in to Beximco again

Beximco Ltd got its way, yet again. The central bank went out of its way to accept Beximco’s request for rescheduling demand loan of Tk 430.05 crore, and in so doing, created a moral hazard for the banking sector.

12 September 2019, 18:00 PM

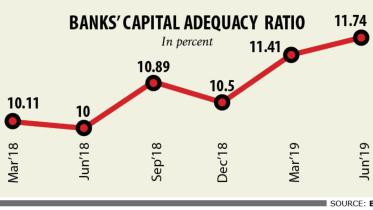

Banks’ capital base strengthens

The banking sector’s capital base strengthened on paper in the second quarter of the year after some banks were allowed to keep

9 September 2019, 18:00 PM

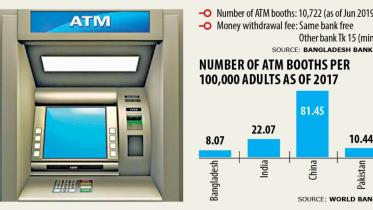

Non-bank entities can soon set up ATMs

The central bank will allow non-bank entities to set up automated teller machines (ATMs) and point of sale (POS) terminals as it ramps up efforts to promote card-based transactions across the country.

7 September 2019, 18:00 PM

Banks hardly lend via agent banking

Banks are showing reluctance in lending through the agent banking window based in rural areas despite mobilising large sums through the platform.

1 September 2019, 18:00 PM

11 Large Borrowers: BB paves way for fresh rescheduling

In a reversal of its stance, Bangladesh Bank yesterday paved the way for 11 large business groups to reschedule their loans even though they restructured their loans four years ago on condition of regular repayments.

27 August 2019, 18:00 PM

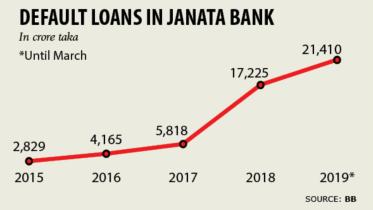

Defaulter Root Group to get fresh loans from Janata

In a baffling move, the central bank is set to allow precarious Janata Bank to reschedule default loans amounting to Tk 1,049 crore of little-known Root Group that ranks 49 out of the top 300 defaulters in the country.

21 August 2019, 18:00 PM

Trade deficit shrinks on low imports

Trade deficit narrowed down to 15 percent last fiscal year thanks to a decline in imports and steady growth of exports, bringing some breathing room for the government for the time being.

19 August 2019, 18:00 PM

BB policy sparks flurry of loan write-offs

Loan write-offs almost quadrupled in the first quarter of the year on the back of the central bank’s easing of rules, in a sobering reminder of the banking sector’s deteriorating financial health.

18 August 2019, 18:00 PM

BB plans uniform method to calculate cost of funds

The central bank is set to come up with a new formula for calculating the cost of funds for banks with a view to bringing down the interest rate on lending, much to the trepidation of bankers.

17 August 2019, 18:00 PM

Want to be the best bank within 5 years

At a time when many banks are struggling to arrest default loans stemming from a lack of corporate governance, Pubali Bank can be a role model for them given its stunning performance in bringing down the bad debt.

10 August 2019, 18:00 PM

e-KYC finally from December

The central bank is set to introduce electronic Know Your Customer (e-KYC) system from December -- a move that would allow account opening without filling in any paper-based documents.

8 August 2019, 18:00 PM

Don’t deposit funds with weak banks

The energy ministry has asked Bangladesh Petroleum Corporation (BPC) and Petrobangla not to deposit their funds with weak financial institutions in the hope of getting higher returns in the form of interest.

7 August 2019, 18:00 PM

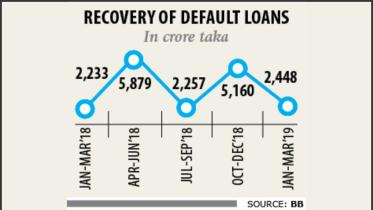

Loan recovery falters in first quarter

Banks’ loan recovery in the first quarter of 2019 was 9.68 percent higher than a year earlier, but given the extraordinary rate at which default loans are increasing it seems below par.

30 July 2019, 18:00 PM

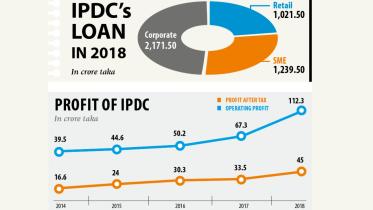

A bright spot in financial sector

IPDC Finance has become a model both for weak and strong banks and non-bank financial institutions (NBFIs) on the virtues of having strong corporate governance, banking on it to jumpstart its flailing business.

29 July 2019, 18:00 PM