Credit growth unlikely to rise

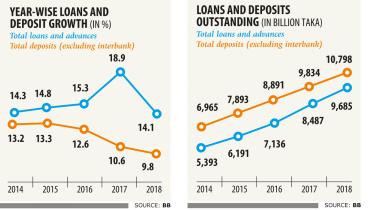

Private sector credit growth, which fell to a six-year low of 11.3 percent last fiscal year, is unlikely to rise in the coming months owing to a liquidity crisis, rising bad loans and the growing incidents of money laundering, analysts said.

29 July 2019, 18:00 PM

Private credit growth target may be 15pc

The central bank may set a 1.5 percentage points lower private sector credit growth target for the second half of the year amid the shrinking demand for credit.

27 July 2019, 18:00 PM

Bad loans put Janata in trouble

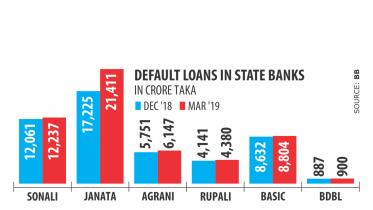

State-run Janata Bank’s provisioning shortfall has hit a whopping Tk 8,256 crore, the highest-ever deficit for any bank in the country, putting depositors’ money at risk.

23 July 2019, 18:00 PM

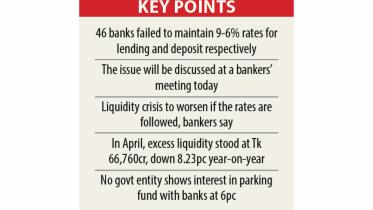

BB bent on 9-6pc interest rates

The central bank is adamant about having 9 percent and 6 percent interest rates respectively for lending and deposits in the banking

20 July 2019, 18:00 PM

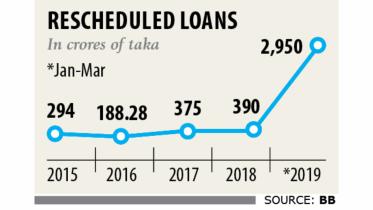

Record loan rescheduling at Social Islami Bank

Social Islami Bank rescheduled a record amount of loans in the first quarter of 2019 and yet failed to arrest its default loans from

16 July 2019, 18:00 PM

Dhaka Bank sets sights on digital transformation

Dhaka Bank is increasingly embracing digital transformation to serve its clients better as tech-savvy customers expect advanced

13 July 2019, 18:00 PM

People’s Leasing faces liquidation

The government has directed the central bank to liquidate People’s Leasing and Financial Services (PLFS), a non-bank financial institution, due to deterioration of its financial health in the last several years.

8 July 2019, 18:00 PM

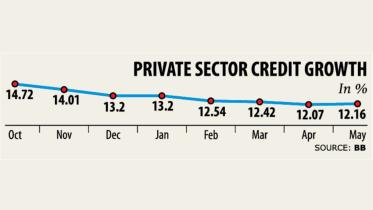

Private credit bucks falling trend

Private sector credit growth edged up in May after sliding since October last year but it is still well below the central bank’s target for the second half of fiscal 2018-19.

3 July 2019, 18:00 PM

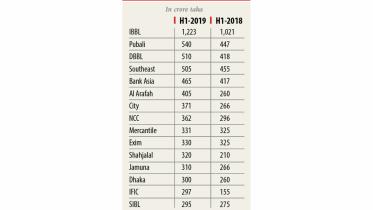

Banks’ operating profit rises despite liquidity crisis

Most of the private banks saw their operating profits edge up in the first half of the year despite the ongoing liquidity crisis and a

1 July 2019, 18:00 PM

Most state banks hit by capital deficit

Six of the eight state banks faced capital shortfall in the first quarter of the year, a development that shoves the government under the

30 June 2019, 18:00 PM

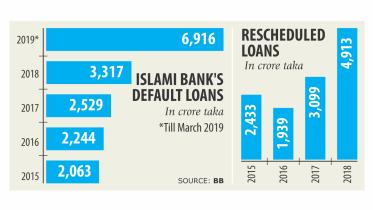

Islami Bank’s default loans double in three months

Despite rescheduling huge amount of loans, the default loans of Islami Bank Bangladesh Ltd (IBBL) more than doubled to Tk 6,916

29 June 2019, 18:00 PM

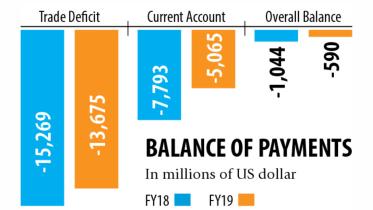

Current account deficit shrinks 35pc to $5b

Bangladesh’s current account deficit continues to pose risks to macroeconomic stability despite its 35 percent fall in the first 10

23 June 2019, 18:00 PM

Bank cards to be costlier

The cost for issuing new credit and debit cards will balloon 3-6 times after the government imposed fresh duty on the imported items,

17 June 2019, 18:00 PM

Spare banks from stock dividend tax

Banks have sought to be excused from the government’s plan to introduce 15 percent tax on stock dividend and retained earnings

16 June 2019, 18:00 PM

PLEDGES there, ‘HOW’ missing

Rejaul Karim, a college teacher by profession, took a personal loan of Tk 6 lakh at 9.50 percent interest from a private commercial bank in 2015 to tackle some family emergencies.

13 June 2019, 18:00 PM

State banks weighed down by bad loans

Default loans in state-run commercial banks soared 10.64 percent, or Tk 5,184 crore, in the first quarter of the year -- in the

12 June 2019, 18:00 PM

Fix banking woes

The government should go for massive reforms to salvage the ailing banking system or else the contagion will batter the entire financial sector, analysts said.

10 June 2019, 18:00 PM

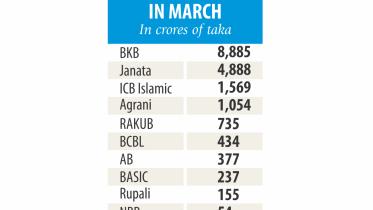

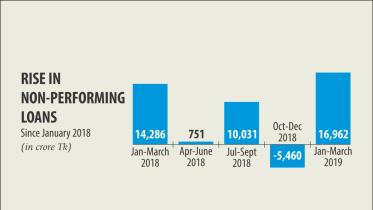

Bad loans soar

Defaulted loans soared to Tk 110,874 crore as of March this year, the highest ever in the country.

10 June 2019, 18:00 PM

Sluggish deposit growth poses stability risks: BB

The continued slowdown in deposit growth can go on to raise concerns of stability of the banking sector, said a Bangladesh Bank report -- in a pressing call to the government to cut down the interest rate on national savings certificates.

8 June 2019, 18:00 PM

EBL getting ready to fund big projects

At a time when most lenders are battling liquidity crisis, rising default loans and poor governance, Eastern Bank Limited (EBL) is sitting pretty by all accounts.

8 June 2019, 18:00 PM