Loans from Janata, NBL: S Alam, Nassa got Tk 2,544cr waiver in breach of rules

Chattogram-based conglomerate S Alam Group and garment manufacturer Nassa Group were given interest waivers amounting to Tk 2,544 crore bypassing banking rules, in a testament to the outsize influence oligarchs had on the banking sector during the Awami League-led government of the past 15 years.

15 August 2024, 18:00 PM

Salman used clout to help businesses secure loans

Salman F Rahman is known for using his influence to get bank loans for Beximco Group by bending rules, but documents seen by this newspaper have revealed how he helped others secure credit, or at least tried to.

15 August 2024, 18:00 PM

Beximco leaves Janata Bank in poor health

What is the purpose of a single borrower exposure limit? It is to ensure that a bank’s fortune is not tied to the ebb and flow of a conglomerate’s business.

14 August 2024, 18:00 PM

$600m loans from EDF turn sour

Loans amounting to nearly $600 million, or Tk 7,000 crore, disbursed from the Export Development Fund (EDF), which was formed based on the country’s foreign exchange reserves, have been defaulted, according to a Bangladesh Bank (BB) document.

13 August 2024, 18:00 PM

BB cuts special liquidity support for nine banks

The Bangladesh Bank reduced the special liquidity support extended to nine lenders, including five Shariah-based banks, despite the absence of a governor.

13 August 2024, 18:00 PM

Who will be the next BB governor?

Abdur Rouf Talukder resigned from the post of governor of the Bangladesh Bank on Friday, four days after Sheikh Hasina stepped down as prime minister and fled the country in the face of a mass uprising.

10 August 2024, 18:00 PM

BB loses Tk 55cr in forex deals with Islami Bank

The Bangladesh Bank has incurred a loss of Tk 55 crore from its foreign exchange deal with Islami Bank centring the introduction of the crawling peg exchange rate system.

10 August 2024, 18:00 PM

Islami Bank rejects cheque seeking to withdraw Tk 548cr

Islami Bank Bangladesh today rejected a cheque of a little-known company seeking to withdraw Tk 548 crore

7 August 2024, 15:52 PM

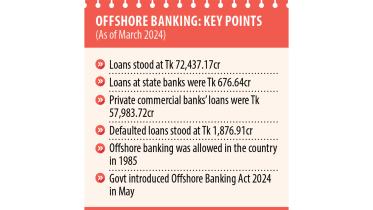

Banks see lower offshore lending amid forex crisis

Lending from offshore units of banks in Bangladesh has declined amid the ongoing foreign exchange crisis, leaving the segment in a fragile situation.

5 August 2024, 18:00 PM

Window stays open to keep lending rates at low level

There is a lot of talk over a recent hike in interest rates but there is still scope to keep lending rates at a low level, said Md Afzal Karim, managing director of Sonali Bank.

28 July 2024, 18:00 PM

Internet outage, curfew: Default loans to soar, banks’ profit to dip

Bankers are dreading a big drop in their profits as their defaulted loans are likely to increase further due to the curfew and the five-day internet blackout.

27 July 2024, 18:00 PM

Is Islamic finance facing headwinds?

Rabiul Islam, a practising Muslim who works at a private organisation, refrained from conventional banking services for many years as both paying and receiving interest are against his religious principles.

26 July 2024, 18:00 PM

Remittance collection disrupted

The internet blackout for five days has affected remittance collection through banks and mobile financial services (MFS), which may put pressure on the country’s foreign exchange reserves.

25 July 2024, 18:00 PM

Banks waive penalty for delayed loan repayment

Some banks have decided not to impose any interest or fees on clients for delayed payment of loan instalments, including that against credit cards, amidst a nationwide curfew and internet blackout.

23 July 2024, 18:00 PM

ATM services, digital banking disrupted

Online banking, ATM and digital payment services including money transfers and utility bill payments continued to be disrupted yesterday amid the ongoing internet blackout across the country since Thursday.

20 July 2024, 18:00 PM

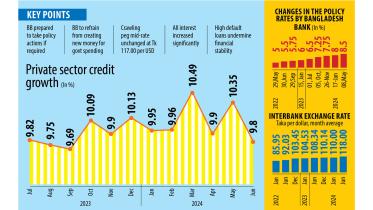

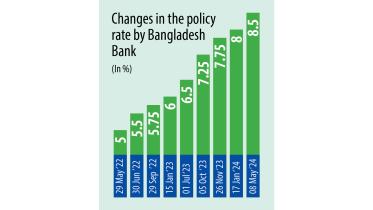

BB keeps key policy rate unchanged but signals further tightening

Despite suggestions for a policy rate hike from the International Monetary Fund (IMF) and economists, the central bank of Bangladesh has kept unchanged the major tool of its monetary policy at 8.5 percent although inflation is running high.

18 July 2024, 18:00 PM

BB to keep policy rates high to curb inflation

Bangladesh Bank is going to unveil the monetary policy for the first half of fiscal year 2024-25 tomorrow and is expected to retain its tight monetary stance as its foremost target is to bring down the spiralling inflation.

16 July 2024, 18:00 PM

A country where loan defaulters are rewarded!

All over the world, strict actions are taken against loan defaulters, with many countries imposing travel bans and seeking legal recourse. In Bangladesh, however, defaulters get mega-discounts.

14 July 2024, 18:00 PM

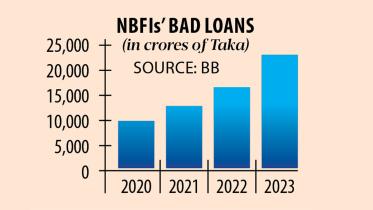

NBFIs’ bad loans surge to a record Tk 23,208 crore

Defaulted loans at non-bank financial institutions (NBFIs) soared 38 percent to a record Tk 23,208.7 crore at the end of 2023, raising concerns over the sector’s deteriorating health.

11 July 2024, 18:00 PM

BB signals further monetary tightening as inflation rages

The central bank has signalled that it would go for more tightening of the monetary policy since inflationary pressure shows no signs of cooling.

11 July 2024, 18:00 PM