Auditor finds Tk 1,373cr unauthorised deals at Uttara Finance

An external auditor has found unauthorised transactions worth Tk 1,373 crore at Uttara Finance and Investments Limited, a listed non-bank financial institution (NBFI).

The Dhaka Stock Exchange (DSE) published the audit report yesterday.

The report said the auditor, who was appointed by the Bangladesh Bank, reviewed the company's financial statements for 2020 and issued a qualified opinion after detecting several irregularities.

A qualified opinion is an auditor's statement indicating that a company's financial records contain material misstatements or do not fully comply with accounting standards.

According to the report, "Tk 1,373.31 crore unauthorised transactions were identified in the special audit where established internal procedures, borrower due diligence and prudential guidelines for approving transactions and paying loans were not followed."

The audit also showed that Uttara Finance had provided a loan of Tk 147.34 crore to its subsidiary UFIL Capital Management as of December 2020.

The repayment of that loan was irregular. Instead of repayment through business income, the parent company injected additional equity (share capital) into the subsidiary, which was then used to repay the same loan.

It is a circular movement of funds that masks the true financial position.

"Uttara Finance shows total receivable against unauthorised transactions of Tk 1,654 crore, mostly related to connected parties, which remain unadjusted for at least one year," said the auditor.

The report said that the central bank had instructed the company to record a block liability, a large provision set aside to cover potential losses, of Tk 2,150 crore against these unauthorised transactions.

However, no specific provision has yet been maintained in the company's balance sheet.

The audit also found that some loans had turned classified under central bank rules, meaning they had become non-performing or overdue.

When calculating loan-loss provisions (funds set aside to cover possible defaults), Uttara Finance depended on collateral securities -- assets pledged against loans -- that had not been revalued for a long time.

According to the auditor, this made it impossible to confirm whether their current market value was adequate to cover the risks.

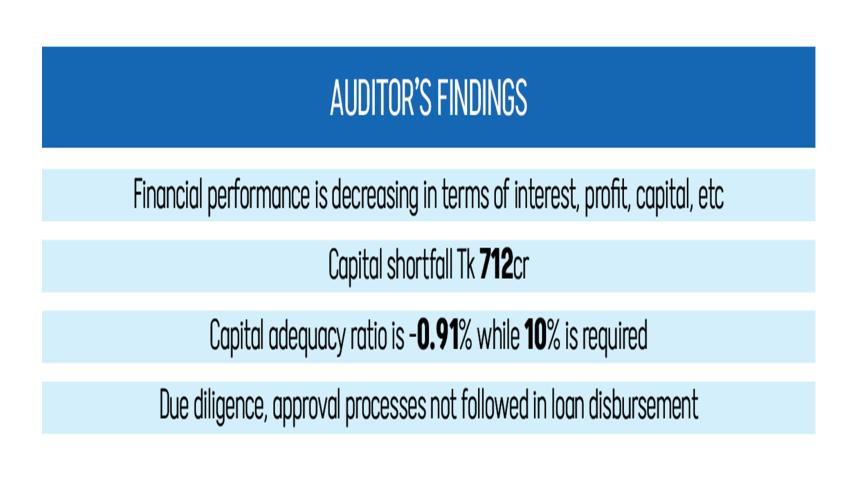

In addition, the auditor found that proper due diligence and approval processes were not followed in several loan disbursements.

The audit also detected significant discrepancies between earlier account balances and the figures published in previous financial statements.

In 2020, Uttara Finance reported a net interest loss of Tk 61 crore, a net loss after tax of Tk 435 crore, and a capital shortfall of Tk 712 crore. These figures indicate a steady deterioration in profitability and financial health.

As per Bangladesh Bank regulations, every financial institution must maintain a minimum paid-up capital, money directly invested by shareholders, of Tk 100 crore.

Moreover, the combined total of paid-up capital and reserves must meet a minimum requirement based on the company's risk-weighted assets, which measure exposure to potential financial losses.

Uttara Finance currently faces a capital shortfall of Tk 712 crore.

The auditor also raised an emphasis of matter, noting that it needed access to data from the company's core financial software for verification.

"During the course of our audit, we observed that the company maintains its books of accounts in Telis ledger balance, which is not in a systematic and verifiable manner within its software system," the report said.

It added that the company's records and balances were compiled using available information, bank statements, manual calculations and schedules, rather than complete digital records.

Md Ataur Rouf, company secretary of Uttara Finance, said the new board is "trying to recover all the funds that were provided in an unauthorised way".

He added that the board is alert and working under the central bank's supervision.

The company's financial reports were delayed for years after the Bangladesh Bank detected anomalies when Uttara Finance sought to issue cash dividends based on its misstated 2019 accounts. That report was later restated, and the corrected 2020 report has since been submitted, Rouf said.

Auditors are now working on the 2021 accounts. "Soon all the financial reports will be finalised, so investors will get a clear picture of the company," he added.

Shares of Uttara Finance fell 1.5 percent to Tk 13 on the DSE yesterday.

Earlier in December 2020, the central bank detected major financial irregularities during a special inspection. As part of follow-up action, it appointed Rahman Rahman Huq (KPMG) in May 2021 to conduct an independent audit.

KPMG later reported "massive financial engineering" at Uttara Finance, finding that published figures differed widely from actual accounts in nearly all areas, such as assets, liabilities, income and expenses.

The report alleged that these discrepancies were the result of collusion between the former board and management.

Following the report, the Bangladesh Bank removed the sponsor directors and appointed a new board in 2022.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments