Islamic bank deposits keep rising

Deposits flowing to Islamic banks rose in the April-June quarter of 2025, buoyed by a sharp increase in the number of customers thanks to a renewal of confidence.

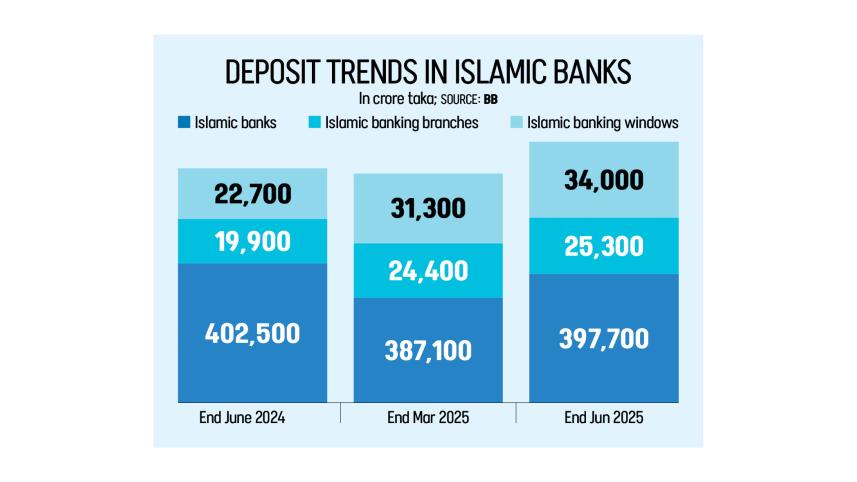

Total deposits stood at Tk 4.57 lakh crore at the end of June, up 3.22 percent from Tk 4.42 lakh crore three months earlier.

The volume of deposits was also 2.67 percent higher than that a year ago, Bangladesh Bank said in its quarterly report on Islamic banking.

Of the total, deposits of 10 full-fledged Islamic banks amounted to Tk 3.97 lakh crore, while Islamic banking branches of conventional banks held Tk 25,333 crore and Islamic windows Tk 34,083 crore.

The 10 dedicated Islamic banks accounted for 87 percent of the system's deposits, with branches and windows representing 5.54 percent and 7.45 percent, respectively.

This was the third consecutive quarter in which Shariah-based banks recorded growth in deposits since the July–September period, when savings fell as low as Tk 4.36 lakh crore due to an erosion of confidence amid allegations of loan irregularities.

In its latest report, the BB said it has provided liquidity support to the weak Islamic banks through various windows to help them operate.

Besides, the BB also recently dissolved governing bodies of major Islamic banks and restructured those bodies to bring back public confidence in the aftermath of last year's regime change, it said.

"It is expected that these pragmatic steps will help the Islamic banks attain public confidence and lead the sector to operate on a sound footing," it added.

The BB report said overall, the total number of deposit accounts climbed from 3.6 crore in March this year to 3.9 crore at the end of June.

The overall number of investment accounts, however, decreased slightly during the period.

At the end of June, Islamic banks accounted for 24.35 percent of total deposits and 29.18 percent of investments of the entire banking sector.

The report said Islamic banks have been able to establish themselves as an alternative funding source in the economic development of Bangladesh. Over the period, the sector has been gaining an increasing market share of the overall banking industry.

However, the number of rural branches of full-fledged Islamic banks has not kept pace with demand. "They may focus more on expanding their outreach into rural areas," said the report.

The report said Islamic banks may invest more in industries that bring about social benefits, particularly in agriculture and small businesses.

The BB said some full-fledged Islamic banks had faced severe liquidity crises in the recent past due to irregularities and a lack of good governance.

"So, it is essential to establish good governance in the Islamic banking system, as good governance and accountability are key to navigating the current crisis and ensuring sustainable growth of this sector," said the central bank.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.