Source tax a burden for many: study

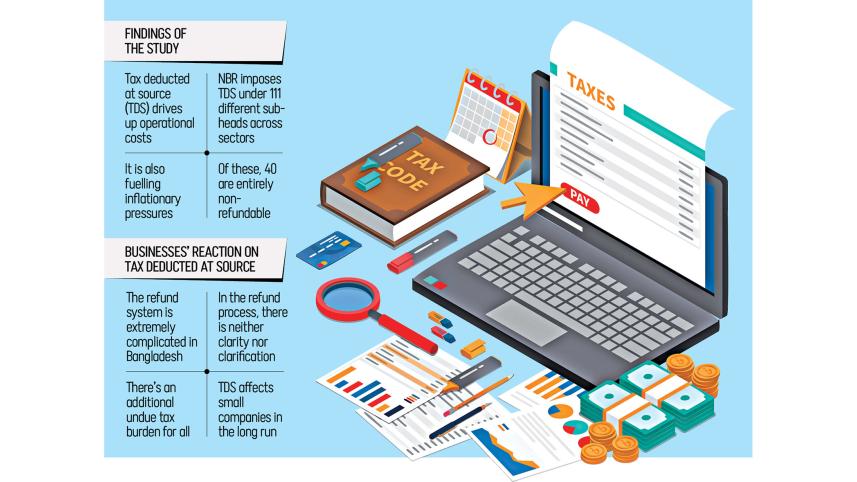

Tax deducted at source (TDS) has emerged as a heavy burden for businesses, driving up operational costs and fuelling inflationary pressure, said a new study by Business Initiative Leading Development (BUILD), a public-private dialogue platform.

According to the findings, the National Board of Revenue (NBR) imposes TDS under 111 sub-heads across sectors.

Of these, 40 are entirely non-refundable. Even among the 71 refundable sub-heads, businesses have managed to recover only 0.29 percent of the deducted sums.

This means that in practice, 99.71 percent of TDS ends up functioning as a minimum tax, the study found.

Wasel Bin Shadat, research director of BUILD, revealed the findings at a dialogue on "Policy Reform Requirements for Non-Adjustable TDS" organised by BUILD at the Dhaka Chamber of Commerce & Industry in Dhaka yesterday.

TDS becomes a part of the value of the product or service, which directly increases the price and finally fuels yearly inflation, he said.

In FY23, TDS on local letters of credit (L/C) collected by the NBR was Tk 124 crore.

Taxpayers are discouraged from being in the tax network as the taxable entity feels that TDS paid is a final discharge as minimum tax, he said.

Talking with The Daily Star, Md Nooruzzaman, senior research associate of BUILD, said many industries were also subject to separate minimum tax requirements.

"When you combine TDS with minimum tax, the total tax incidence increases threefold," he added.

Citing examples, he said the total tax incidence in the cement sector stands at around 75 percent, while in the steel industry it is nearly 89 percent.

Echoing the same, Abul Kasem Khan, chairperson of BUILD, said, "The refund system is extremely complicated in Bangladesh. And in this refund process, there is neither clarity nor certainty."

"There's an additional undue tax burden for all, especially affecting small companies for a long time," he said.

"Large firms can afford tax teams, but for small entrepreneurs with only a few people, compliance is extremely difficult," he said.

For entrepreneurs of small-scale enterprises — one-man shows, two-man shows, even 10-man teams — it becomes extremely difficult to manage, he said.

"That's where it starts: people don't declare their income or don't declare the business at all. And that's happening because of structural or policy deficiencies."

Tax is typically applied on profit, but in Bangladesh, TDS is often imposed on revenue instead.

In many cases, this tax is not refundable or is not treated as prepaid. As a result, the effective tax rate, which should have been nearly 27.5 percent, ultimately ends up being 30 percent to 45 percent in many cases.

Citing his own company's case, he said, "We have paid between 45 percent and 48 percent so far. If this continues for the next five years, my company will have to shut down."

"If the goal is to increase tax revenue, the priority should be to expand the VAT net rather than burdening businesses with excessive deductions," said Snehasish Barua, managing director of SMAC Advisory Services.

"We recommend reducing the import tax on raw materials to 1 percent, as this would ease pressure on industries while ensuring competitiveness," he said.

"The TDS should be set using industry-specific profitability data, and collections must be reconciled with non-filers to ensure fairness and wider coverage," he said.

Speaking as the chief guest, NBR Chairman Md Abdur Rahman Khan said, "Globally, TDS is considered a painless system. But in Bangladesh, the core problem is that adjustments are not made and the process to get refunds remains extremely complex."

Admitting the flaw, he noted that a large group of people have taxes deducted even though they have no taxable income. "Yet we do not provide refunds, which is a serious weakness in our system," he said.

The NBR chairman assured that a virtual refund system was likely to be introduced from next month.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.