Increase efforts to recover bad loans

There was a time when many international financial agencies hailed Bangladesh as the fastest-growing economy in South Asia. However, after the ouster of Sheikh Hasina's corrupt, authoritarian regime, it was revealed that many of the numbers used to calculate this growth had been inflated—manipulated to hide the country's looted coffers. Today, the once thriving economy is burdened with non-performing loans (NPLs).

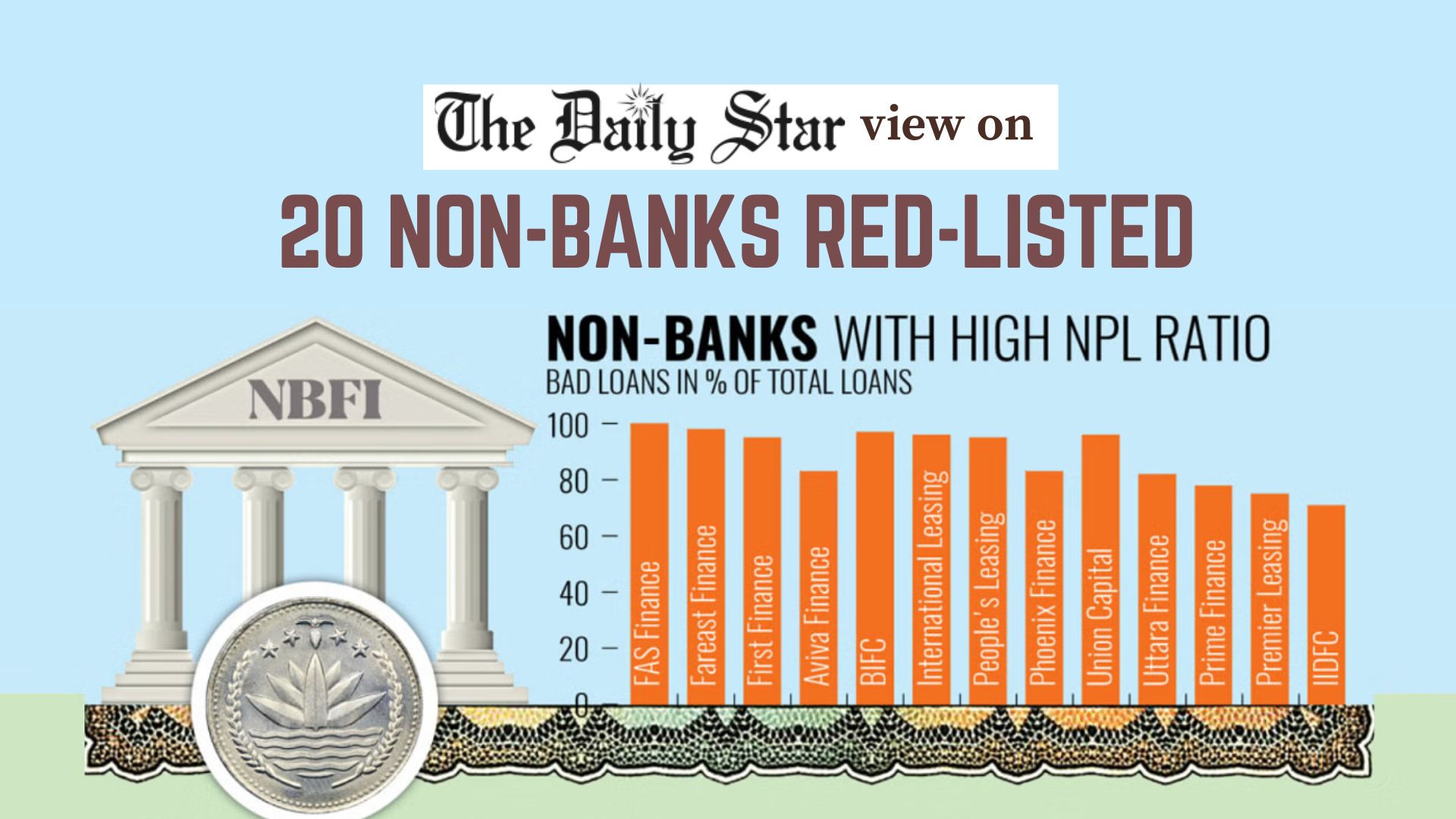

A report published by the Asian Development Bank (ADB) in August 2025 revealed that, in 2024, Bangladesh had the highest NPL ratio (calculated as a percent of total loans) in South Asia: 20.2 percent. Even Sri Lanka, ranking second in the chart, had only 12.9 percent NPL ratio in 2024. Between 2023 and 2024, the NPL ratio also increased the most in Bangladesh—by 11.2 percentage points. During the same period, India, Pakistan and Sri Lanka saw a decline in their respective NPL ratio. In fact, India's NPL amount came down from $69.41 billion in 2023 to $56.31 billion in 2024, because of its sweeping banking reforms.

The reasons behind Bangladesh's high NPLs are well-known. The ADB cited structural weaknesses in credit underwriting and loan resolution, while experts also pointed to regulatory lapses and political interference in loan classification. Under political pressure, defaulted loans from large conglomerates were repeatedly rescheduled, pushing many banks to the brink of insolvency. Following the political changeover last year, the interim government now faces the difficult task of uncovering the full extent of the banking crisis and recovering defaulted loans.

This has led the Bangladesh Bank (BB) to finally tighten the loan classification rules, which it warns will increase the total amount of distress loans, including NPLs, re-scheduled loans and the written-off ones. BB has also been ramping up measures to recover defaulted loans. In a significant move, it recently identified 100 pending lawsuits involving Tk 38,000 crore in bad loans that are preventing banks and financial institutions from taking action against the defaulters by selling their assets and recovering the loans. However, many large defaulters are currently absconding and some have syphoned the money abroad, which complicates the recovery process.

In addition to domestic factors, the amount of NPLs might also rise because of the global economic slowdown caused by trade disputes and geopolitical conflicts. Therefore, it is crucial for the government to not just continue the bad loan recovery process but also take strict disciplinary measures against both borrowers and lenders whose disregard for banking regulations contributed to the crisis. Transparency and accountability in the banking and financial sector must be ensured. Large conglomerates must break free from the default culture that has become normalised in the country. Political parties must also commit to continuing the banking reforms initiated by BB, whoever comes to power through the election next year. Furthermore, legal changes should be made to prevent the proliferation of banks, ensuring that financial institutions are never again exploited to drain the country's resources.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments