Forex crisis now threatens macroeconomic stability

Like all countries in the world, Bangladesh too is facing volatility in the foreign exchange market. This was initially caused by the demand recovery and supply chain disruption as battered economies began recovering from the coronavirus pandemic.

26 March 2022, 18:00 PM

Fund transfer to be instant for NBFIs, forex transactions

Lenders and clients in Bangladesh are set to get the opportunity to settle transactions instantly as the central bank has moved to expand the facility of real-time gross settlement (RTGS) to non-bank financial institutions and the foreign exchange operations of banks.

20 March 2022, 18:00 PM

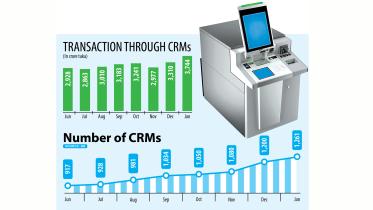

Cash recycling machines fast coming to the fore

Banks are installing cash recycling machines at a faster pace as part of their efforts to provide deposit and cash withdrawal services to clients under the same platform.

17 March 2022, 18:00 PM

Ponzi schemes brought them Tk 6,050cr in just 4 months

Twenty-five controversial e-commerce platforms in Bangladesh were deluged with orders worth a staggering Tk 6,050 crore in just four months last year under Ponzi-like schemes that lured unsuspecting customers on the back of hefty discounts.

16 March 2022, 18:00 PM

Local banks explore ways as SWIFT ban takes effect

Banks in Bangladesh are on the lookout for alternative ways to continue banking with Russian lenders after their transactions with seven major financial institutions came under restriction from SWIFT from yesterday following the western sanction.

12 March 2022, 18:00 PM

Capital shortfall at banks widens

Ten banks in Bangladesh collectively faced a capital shortfall of Tk 34,639 crore in December, which highlighted their fragile health caused by years of irregularities.

10 March 2022, 18:00 PM

IMF for more BB independence

Strengthening Bangladesh Bank’s independence and autonomy is key to enabling it to strictly enforce the current prudential regulations in the banking sector, said International Monetary Fund (IMF).

8 March 2022, 18:00 PM

Current account deficit hits all-time high

Bangladesh’s current account deficit hit an all-time high of $10 billion in just the first seven months of the ongoing fiscal year due to the escalation of trade deficit and dwindling remittances.

8 March 2022, 18:00 PM

Audit firms asked to report NBFI anomalies instantly

The Bangladesh Bank has instructed chartered accounting firms to immediately inform it about any major financial anomalies they unearth while carrying out audits into non-bank financial institutions (NBFIs).

6 March 2022, 18:00 PM

Suspend transactions with Russian banks

Global payments messaging network SWIFT has asked Bangladesh’s banks to suspend transactions with seven Russian lenders since they are facing sanctions from the United States and the European Union over Moscow’s invasion of Ukraine.

3 March 2022, 18:00 PM

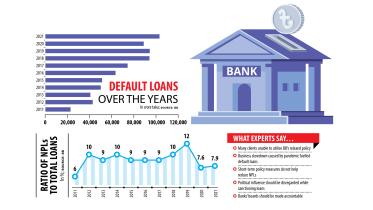

Relaxed policies fail to bring down bad loans

Default loans in the banking sector surged 16.38 per cent year-on-year to Tk 103,274 crore in 2021, rendering the relaxed loan classification policy unveiled by the Bangladesh Bank largely ineffective.

2 March 2022, 18:00 PM

Businesses fear ripple effect of Russian invasion of Ukraine

With oil prices hitting above $100 in the wake of Russia’s invasion of Ukraine, local businesses yesterday feared that the war would have a ripple effect on their domestic and international operations as both countries are major suppliers of agricultural commodities.

24 February 2022, 18:00 PM

Bancassurance set to give much-needed fillip to insurance sector

The government has taken an initiative to roll out bancassurance for the first time in the country with a view to bringing ordinary citizens under insurance coverage through banks.

23 February 2022, 18:00 PM

Nagad-linked investors desperate for multipurpose NBFI licence

A group of investors linked with mobile financial service operator Nagad Ltd have turned desperate to obtain a multipurpose licence that does not exist in Bangladesh.

21 February 2022, 18:00 PM

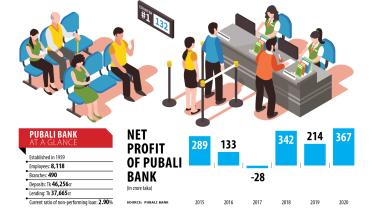

Pubali Bank steps up efforts to grow digitally

The presence of vibrant corporate governance and adoption of technology-driven means have helped Pubali Bank go from strength to strength in widening its banking operations.

16 February 2022, 18:00 PM

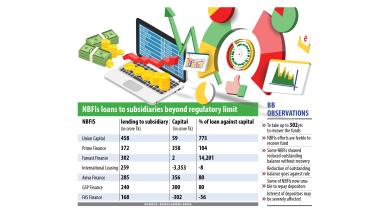

Seven NBFIs risk losing Tk 2,050cr for anomalies

Seven non-bank financial institutions (NBFIs) are now finding it difficult to recover Tk 2,050 crore they had lent to their subsidiaries and associates in breach of rules.

16 February 2022, 18:00 PM

NBFIs barred from disbursing loans on BB cheques

Bangladesh Bank yesterday ordered non-bank financial institutions (NBFIs) not to disburse loans using cheques of current accounts they have to maintain with the central bank.

13 February 2022, 18:00 PM

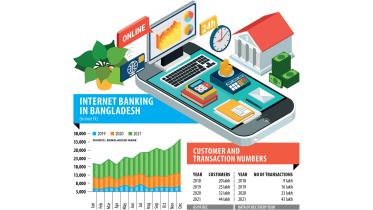

Internet banking thrives

The transition from manual banking to its digital means is certainly not a new phenomenon for Bangladesh’s banking sector. But the advent of the coronavirus pandemic has had clients from all walks of life honing in on internet banking to cut the chances of contracting the deadly flu.

12 February 2022, 18:00 PM

BB asks state banks to rope in more private lenders

With Bashundhara Group seeking to borrow from state banks to establish a gold refining plant at Tk 5,790 crore, Bangladesh Bank yesterday asked five public sector banks to include more private lenders in the syndicated finance scheme to mitigate credit risks.

10 February 2022, 18:00 PM

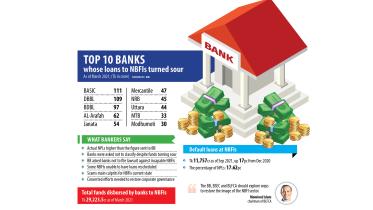

Troubled NBFIs render Tk 1,000cr bank loans sour

Twenty-five banks are suffering from a collective default loan of Tk 974.4 crore after several non-bank financial institutions (NBFIs) failed to pay back funds despite maturity, in another sign of feeble state in the financial industry.

9 February 2022, 18:00 PM