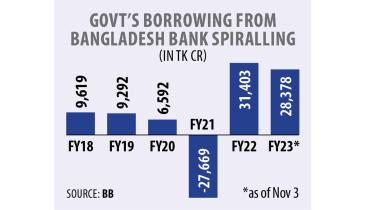

Govt borrowing from Bangladesh Bank stokes inflation fears

In a time of elevated inflation, the government has started to borrow heavily from the Bangladesh Bank to meet the budget deficit, in a move that is set to push up the consumer price level further.

11 November 2022, 02:00 AM

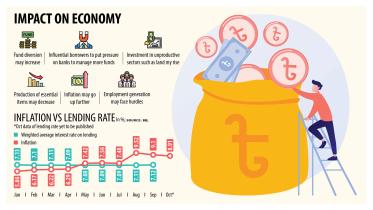

Economy paying the price of cheap funds

The current lending rate, which equals the inflation rate, has brought about major challenges for the economy as a negative interest rate has prompted many large clients to borrow hugely despite subdued demand, giving them the leeway to divert funds to the unproductive sector.

9 November 2022, 02:10 AM

Savers on the receiving end again

The Bangladesh Bank has decided to withdraw the interest rate floor on retail term deposits which had been set by banks equivalent to the average inflation rate of the immediate past three months, said bankers.

6 November 2022, 02:20 AM

BB eases cap on lending interest after 31 months

The Bangladesh Bank has decided to raise the interest rate on consumer loans to 12 per cent from 9 per cent after economists have long called for the withdrawal of the cap on all loans to contain inflation.

6 November 2022, 02:10 AM

State lenders asked to improve health as IMF raises concerns

The Bangladesh Bank yesterday asked four state-owned commercial banks to improve their financial health by containing defaulted loans and broadening capital base after the International Monetary Fund (IMF) expressed concerns about their weak conditions.

4 November 2022, 02:20 AM

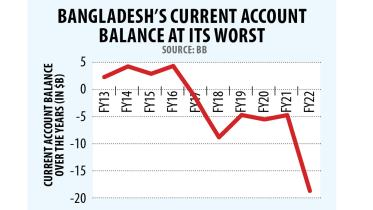

Current account balance: Sinks further in red

Bangladesh’s current account balance sank further in the red in September, heaving the pressure on the exchange rate that is trading at record lows against the US dollar.

3 November 2022, 02:00 AM

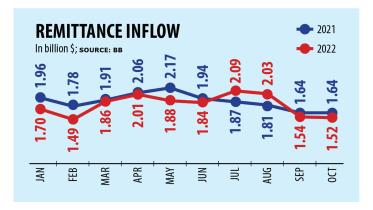

Remittance keeps falling as hundi gains upper hand

Despite a surge in the outflow of migrant workers, remittances to Bangladesh declined 7.4 per cent year-on-year to $1.52 billion in October, an unpromising development that may deepen the volatility in the economy.

2 November 2022, 02:10 AM

Credit growth slows

Private sector credit growth fell by more than two percentage points in September as banks slowed loan disbursement amid liquidity crunch, snapping a seven-month upward trend.

28 October 2022, 02:10 AM

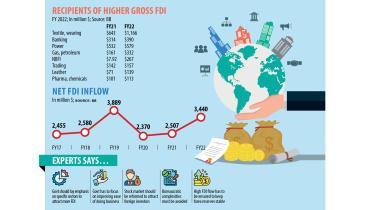

FDI flow soars: 37pc despite economic jitters

Net foreign direct investment to Bangladesh rose 37 per cent year-on-year to $3.43 billion in the last fiscal year, a positive development for the economy amidst the ongoing foreign exchange volatility.

28 October 2022, 02:00 AM

Non-banks urge BB to relax rules of interest rate cap

Non-bank financial institutions have requested the Federation of Bangladesh Chambers of Commerce and Industry (FBCCI) to convince Bangladesh Bank for relaxing some rules related to interest rate cap and loan repayment given their weak financial health.

25 October 2022, 03:40 AM

Liquidity stress major concern for banks

The ongoing liquidity stress has become a major concern for Bangladesh’s banking sector as people hardly park funds with lenders due to higher consumer prices, which have turned the return on deposits negative, said a top banker.

24 October 2022, 02:40 AM

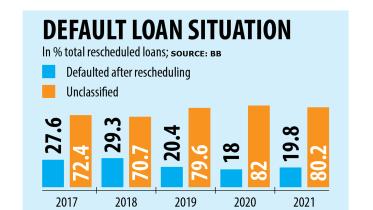

Rescheduled loans too turning bad

The Bangladesh Bank’s policy that allows defaulters longer repayment tenures and easy terms and access to fresh funds has appeared to have failed to make major inroad in bringing down bad debts as rescheduled loans are even turning sour.

20 October 2022, 02:10 AM

9 sectors hold 70pc bad loans

Around 70 per cent of default loans in the banking sector is concentrated in nine sectors of the economy as many borrowers are finding it difficult to pay instalments for the dragging economic slowdown while willful defaulters are also a major factor.

19 October 2022, 02:10 AM

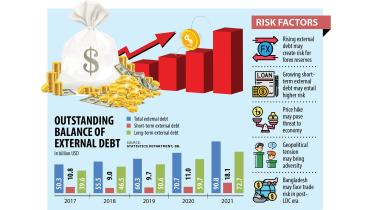

Rising external debt poses risks to forex reserves

Rising external debt may pose some risks to Bangladesh’s foreign exchange reserves in the future as higher debt servicing will be required on accumulated loans, said the Bangladesh Bank yesterday.

18 October 2022, 02:10 AM

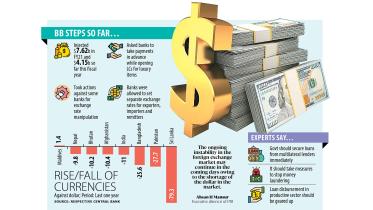

Taka third weakest currency in South Asia

The taka has been rendered one of the worst-performing currencies in South Asia in the last one year because of the plummeting foreign exchange reserves of Bangladesh for higher import payments.

17 October 2022, 02:10 AM

Forex reserves under further strain as BB sells dollar

The injection of the US dollar into the market by Bangladesh Bank has surpassed $4 billion so far in the current fiscal year, creating further pressure on the country’s foreign exchange reserves that are now depleting fast.

14 October 2022, 02:20 AM

Surging inflation: Savers in a tight spot

Savers are now facing losses on their deposits with banks due to surging inflation, with many solely dependent on interest earnings finding themselves in a tight corner.

13 October 2022, 02:00 AM

Sikder Insurance representative denied nod to be NBL director

Bangladesh Bank has denied giving permission to a representative of Sikder Insurance Company to serve as a director of National Bank Ltd (NBL).

11 October 2022, 02:40 AM

Women’s employment in banks rises slightly

The rate of employment of women in Bangladesh’s banking sector has slightly increased to 16.3 per cent in June this year from 15.2 per cent four years earlier.

11 October 2022, 02:20 AM

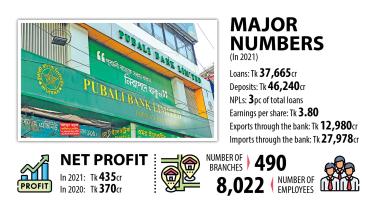

Pubali Bank on a tear

At the time of its denationalisation in 1984, Pubali Bank’s defaulted loans were more than 50 per cent owing to a lack of corporate governance.

9 October 2022, 03:00 AM